2022 State of the Events Industry

Survey Results 💭

📎 Background

We conducted a nationwide survey with event and entertainment production leaders to better understand the current state of the live event industry and share the data, insights, and trends with you.

Thanks to the large participation, we've arrived at some really interesting takeaways.

We hope that these results provide:

- a current pulse of the industry

- interesting insights into how other industry leaders like you are thinking and feeling

- topics we need to discuss more in-depth and openly as a community

📖 Table of Contents

If you want to quickly find the insights most important to you, feel free to use the bulleted links below to jump there.

- Survey demographics

- Bill rates

- Pay rates

- Average lead time

- Surcharges

- Agreements

- Deposits

- Payment terms

- Outsourced event labor

- Crew positions in most need

- Areas of investment

- Virtual event component

- Things you wish end customers understood about how things have changed

- Industry needs that it currently doesn't have

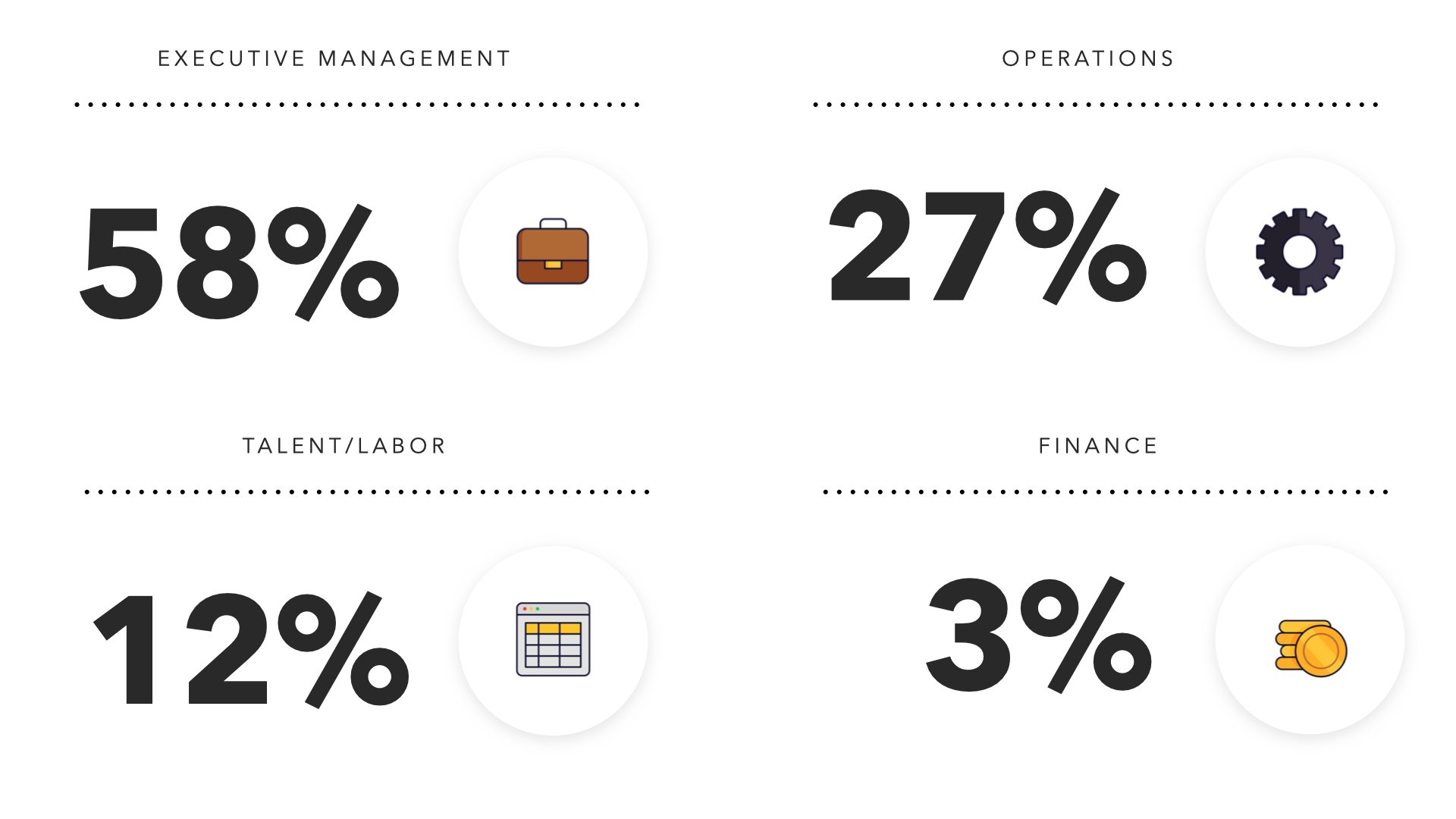

What type of event best represents the majority of your business?

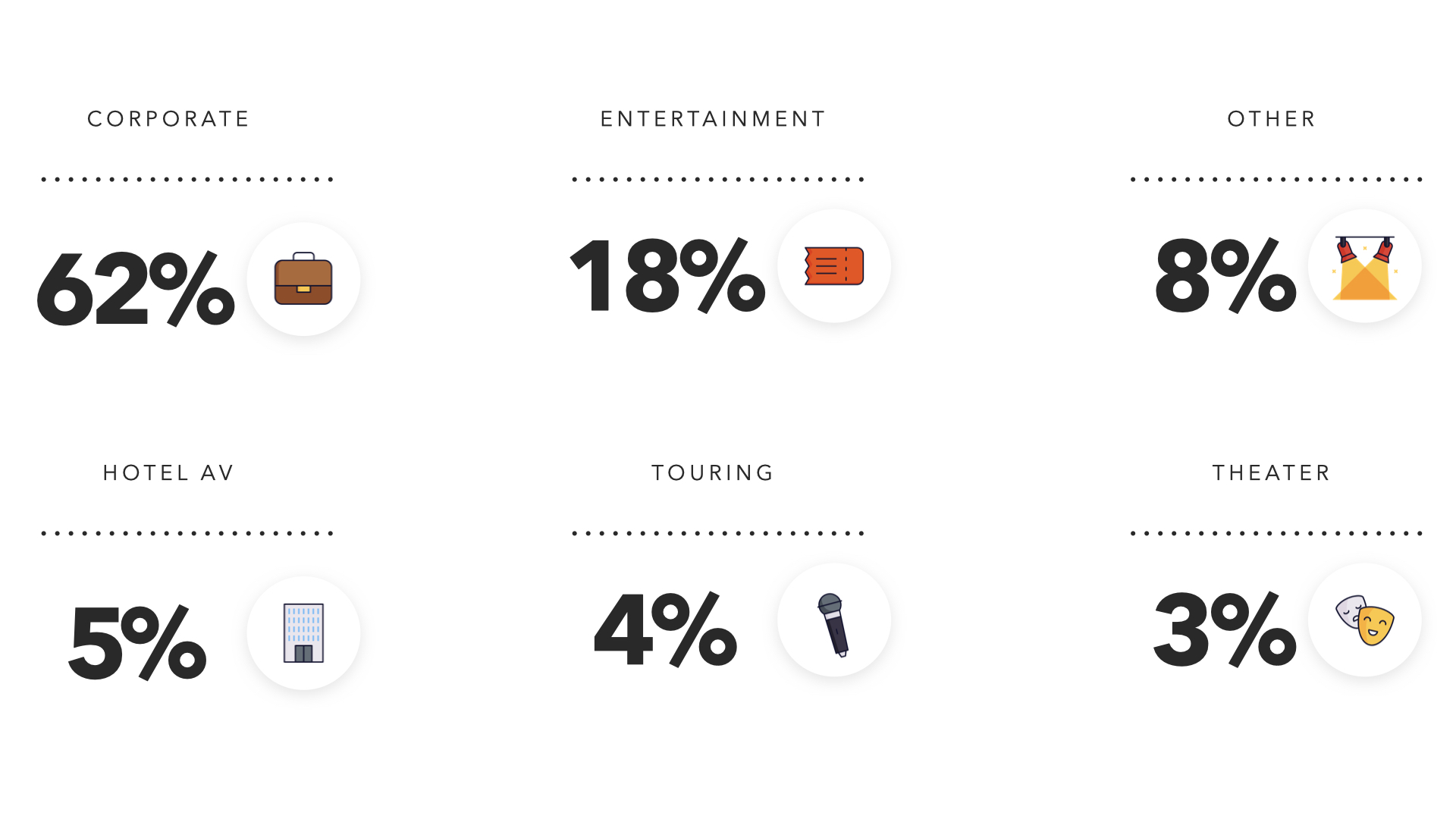

What are the top 3 markets where your events will be held over the next 12 months?

.004.jpeg?width=1920&height=1080&name=Survey%20Images%20(final%3F).004.jpeg)

📌 Results

- 75% said their bill rates have not changed or have only gone up moderately

- 22% said their bill rates significantly increased

- 3% said their bill rates decreased

💡 Takeaway

Margins are suffering. Costs are rising across the board, but only 22% have applied a more than moderate price increase. The time is now to protect your margins.

The industry has an opportunity to educate its clients on rising costs to produce events and apply appropriate pricing.

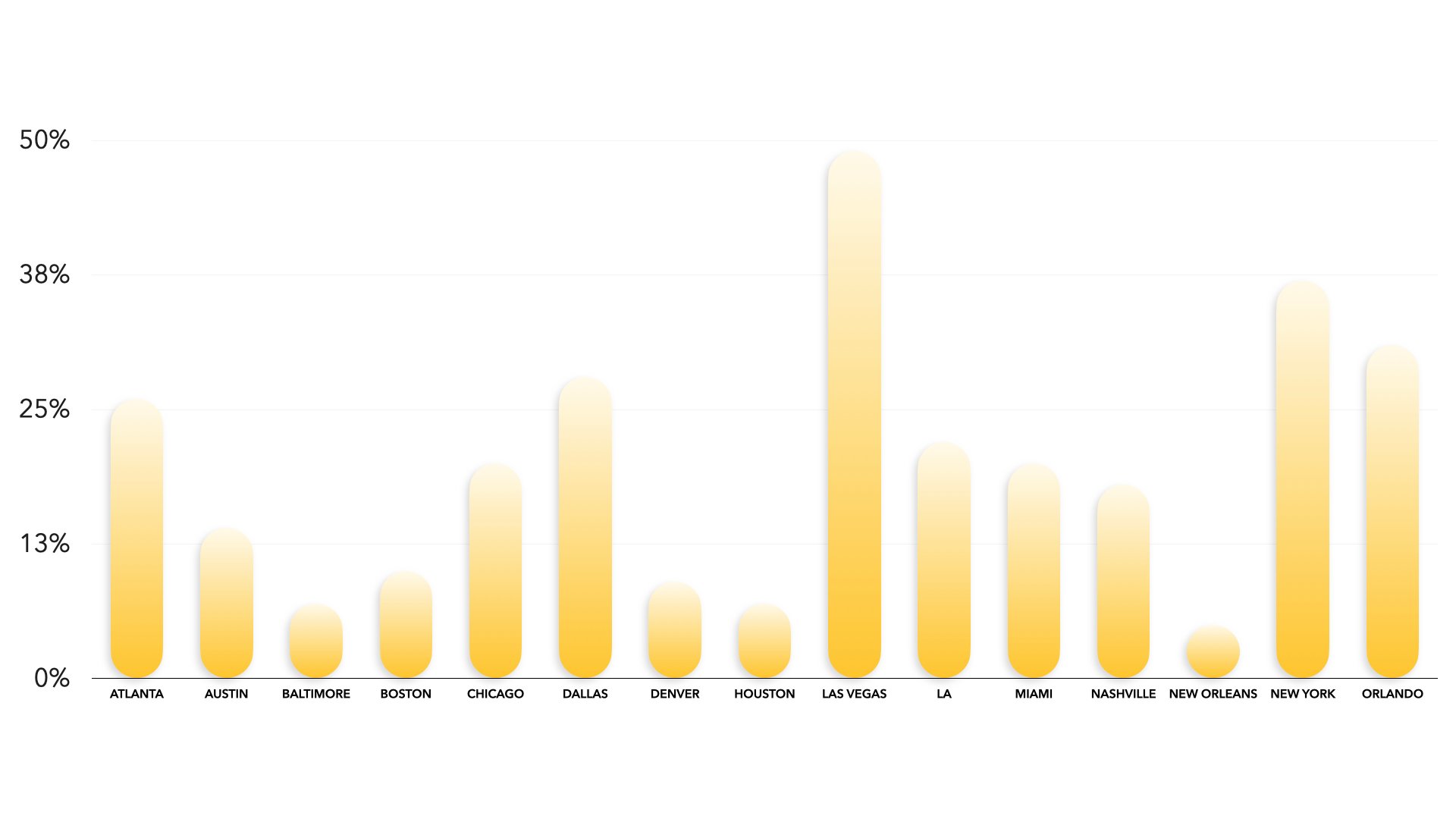

📌 Results

- 68% said their pay rates have either stayed the same or included a moderate increase

- 29% said their pay rates significantly increased

- 3% said their pay rates decreased

💡 Takeaway

Companies have to compete for talent. They are our most valuable asset, yet only 29% of companies have applied a more than moderate pay increase to the people who make these events happen.

The best way to attract great people is to pay them a competitive rate and pay them quickly.

📌 Results

- 59% said their average lead time is less than a month

- 22% said their average lead time is a month

- 19% said their average lead time is several months in advance

💡 Takeaway

Getting in front of the demand is key. Have a buttoned-up process to allow for speed, automate what you can, and be laser-focused on execution. Tighter turnaround times strain access to resources that are in high demand. Additionally, cash is squeezed with less lead time, so collecting healthy deposits is important.

How has your lead time changed in the last two years?

.006.jpeg)

📌 Results

- 92% said their lead time is less than two years ago

- Only 8% said they have more lead time than two years ago

💡 Takeaway

With so much uncertainty over the last two years, event owners struggled to plan in advance, thus creating a collapsed timeframe to pull off great events.

.009.jpeg)

📌 Results

- ~80% don't apply a surcharge for late requests while...

- ~20% do apply surcharges for late requests

💡 Takeaway

With gear and people in high demand, companies are challenged to find resources that are available. The longer you wait, the more expensive it becomes to find quality people and accessible gear.

The industry has an opportunity to incentivize its clients for earlier decisions by applying a late-request surcharge. Educate your clients on how late decisions affect execution.

📌 Results

- 8% said they're taking the initiative to secure multi-year agreements

- 92% said they're doing it on a per-job basis

💡 Takeaway

Prior to the pandemic, many companies secured multi-year agreements.

Now that things are beginning to stabilize and event owners have more predictability for their events in 2023 and beyond, we have an opportunity to bring back proposing multi-year agreements.

Multi year agreements = predictable revenue

.010.jpeg)

📌 Results

- 23% said they don't require deposits at all

- 36% said they require deposits of less than 50%

- 41% said they require deposits of more than 50%

💡 Takeaway

Cash is still king, despite events being back in full swing.

Logistics, gear, and people are all costing you more every single month.

You have an opportunity to increase your cash flow by negotiating healthier deposits upfront.

Take the time to educate your clients, collect more upfront, and then put that money to work by securing your resources earlier.

The good news is 41% of the industry is already collecting deposits of more than 50%.

📌 Results

- 38% said they get paid on receipt

- 60% said their payment terms are net 30

- 1% said their payments terms are net 60

- 1% said their payment terms are net 90

💡 Takeaway

With 62% offering payment terms to clients, speed to invoice is key. The longer you wait to get the invoice out the door, the longer you wait to collect, the more your cash is squeezed.

If you're going to offer payment terms, make sure you have processes and technology tools in place to speed up your time to invoice.

Collect hours and expenses from the field in real-time. Waiting to collect these things and then invoice can elongate your time to collect.

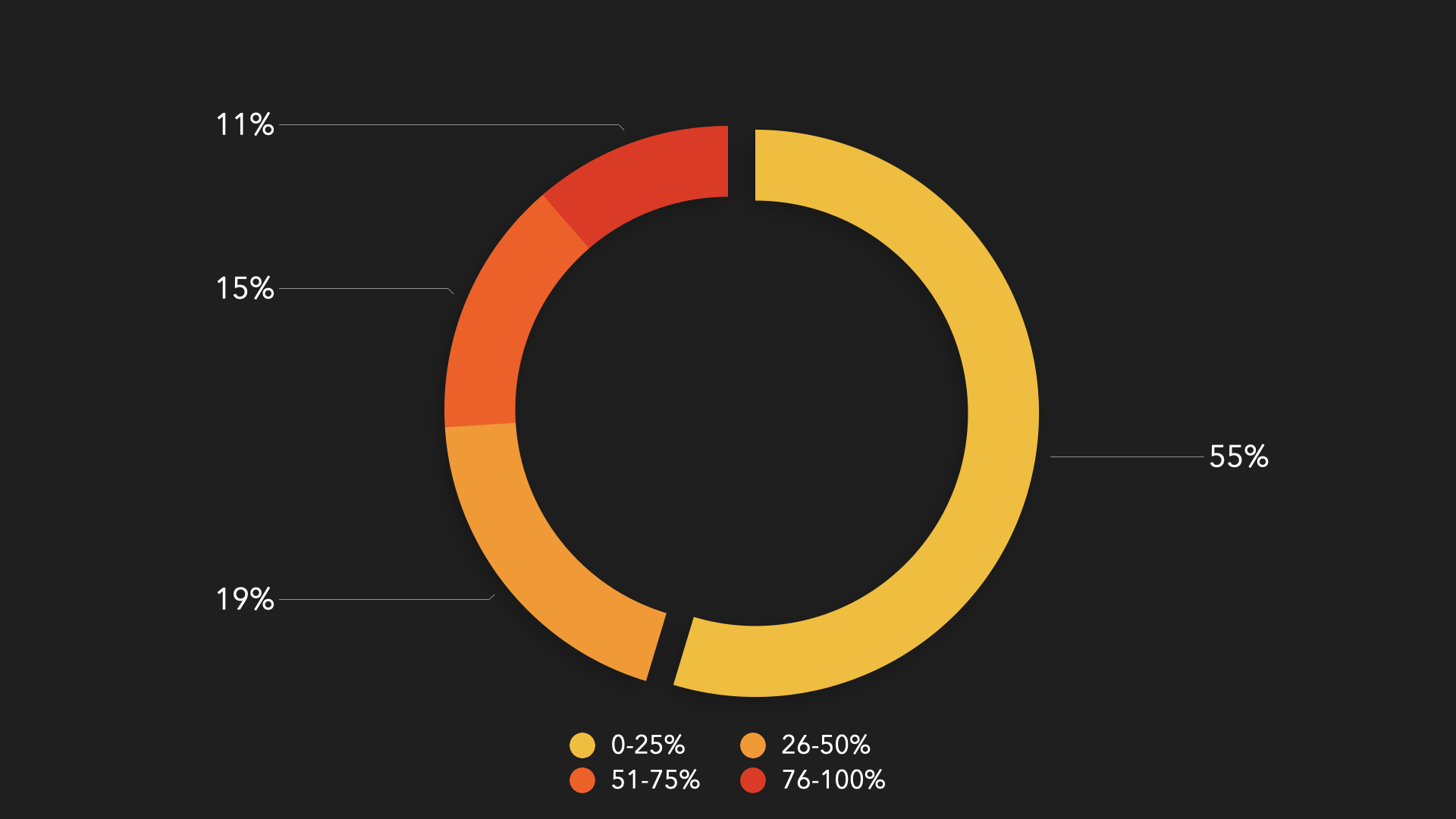

📌 Results

- 55% said they're outsourcing less than one-fourth of their event talent

- 19% said they're outsourcing somewhere between 26-50% of their event talent

- 15% said they're outsourcing somewhere between 51-75% of their event talent

- 11% said they're outsourcing more than three-fourths of their event talent

💡 Takeaway

Companies are still choosing to carry a high fixed cost by carrying the additional overhead to hire talent.

Recruiting talent, onboarding them, training them, traveling them and payrolling them carries an added financial expense.

Despite events being back, companies should continue to take advantage of variable costs when they can.

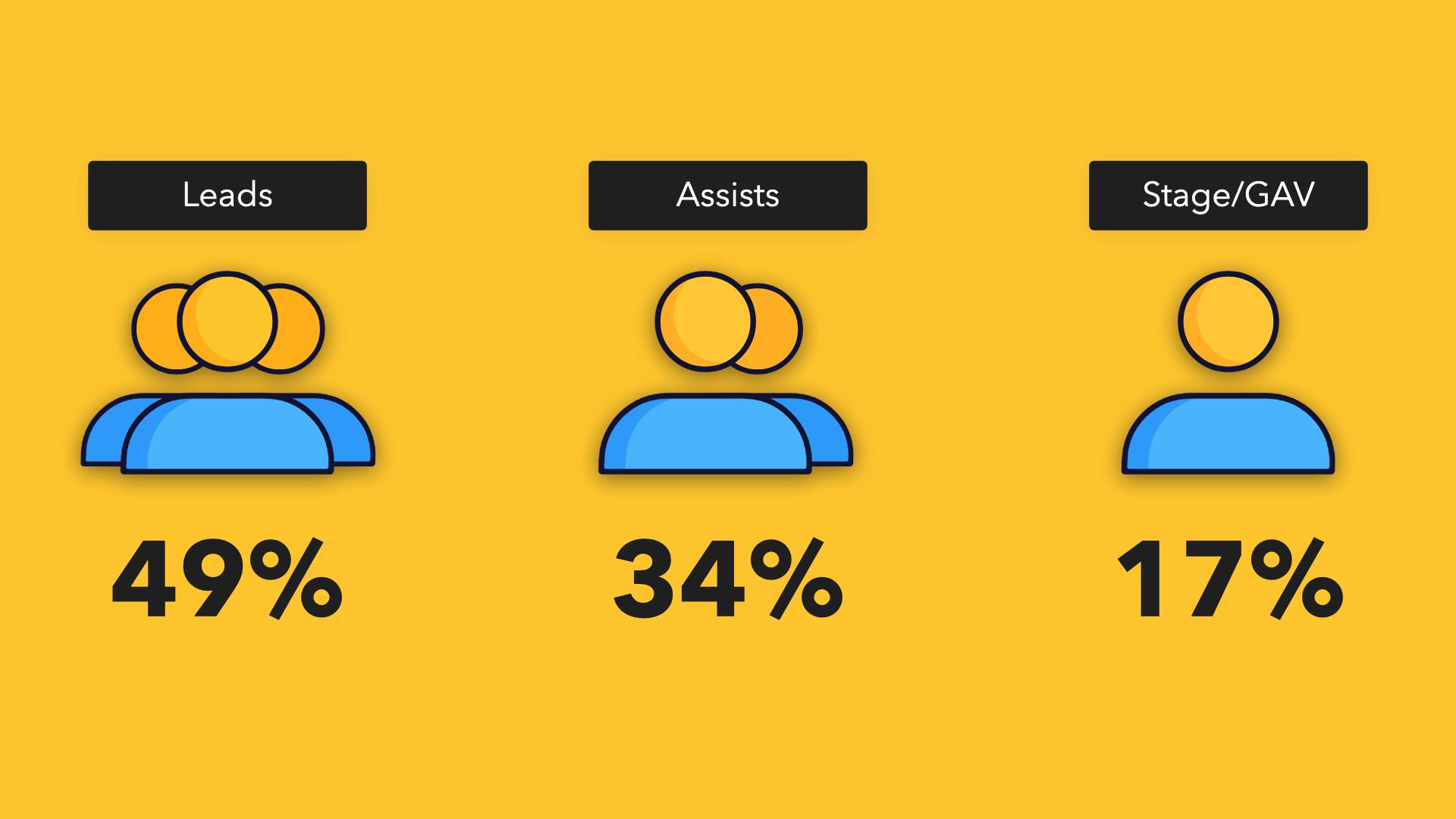

📌 Results

- 49% said they're in most need of crew lead positions

- 34% said they're in most need of crew assist positions

- 17% said they're in most need of crew stagehand and general AV positions

💡 Takeaway

The success of events rests heavily on your lead positions. It is no surprise these talented people are in high demand.

The majority of those that left the industry though are the Assists and Stagehand/Gen AV positions. These also make up the majority of most rosters.

The bottom line is our industry needs more talent across all categories.

📌 Results

- 42% are investing in people

- 26% are investing in gear

- 10% are investing in software

- 22% are investing in processes

💡 Takeaway

Every event experience is only as good as the people who make it happen. No surprise here.

Good people want to work with companies that have good processes and good tools to help them succeed.

Find ways to attract the talent you need and then invest in them.

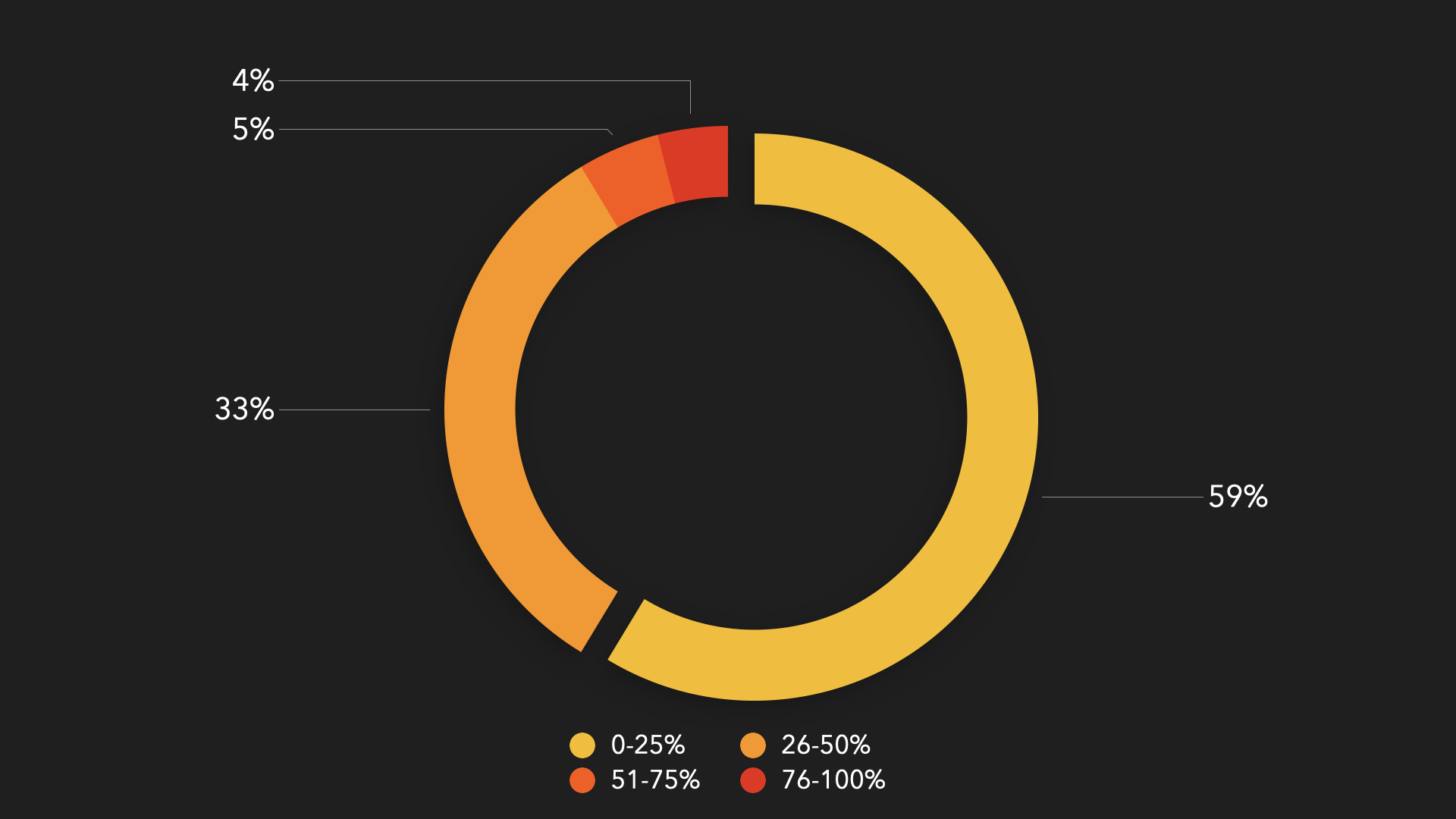

📌 Results

- 59% said less than one-fourth of their contracted events still have a virtual component

- 33% said somewhere between 26%-50% of their contracted events still have a virtual component

- 5% said somewhere between 51%-75% of their contracted events still have a virtual component

- 4% said more than three-fourths of their contracted events will still have a virtual component

💡 Takeaway

Event owners are placing a higher value on human connection and what that means for their companies. Zoom fatigue is a real thing as companies are removing the virtual attendance option to encourage in-person engagements.

There is a lot to gain by getting audiences back together live and in person.

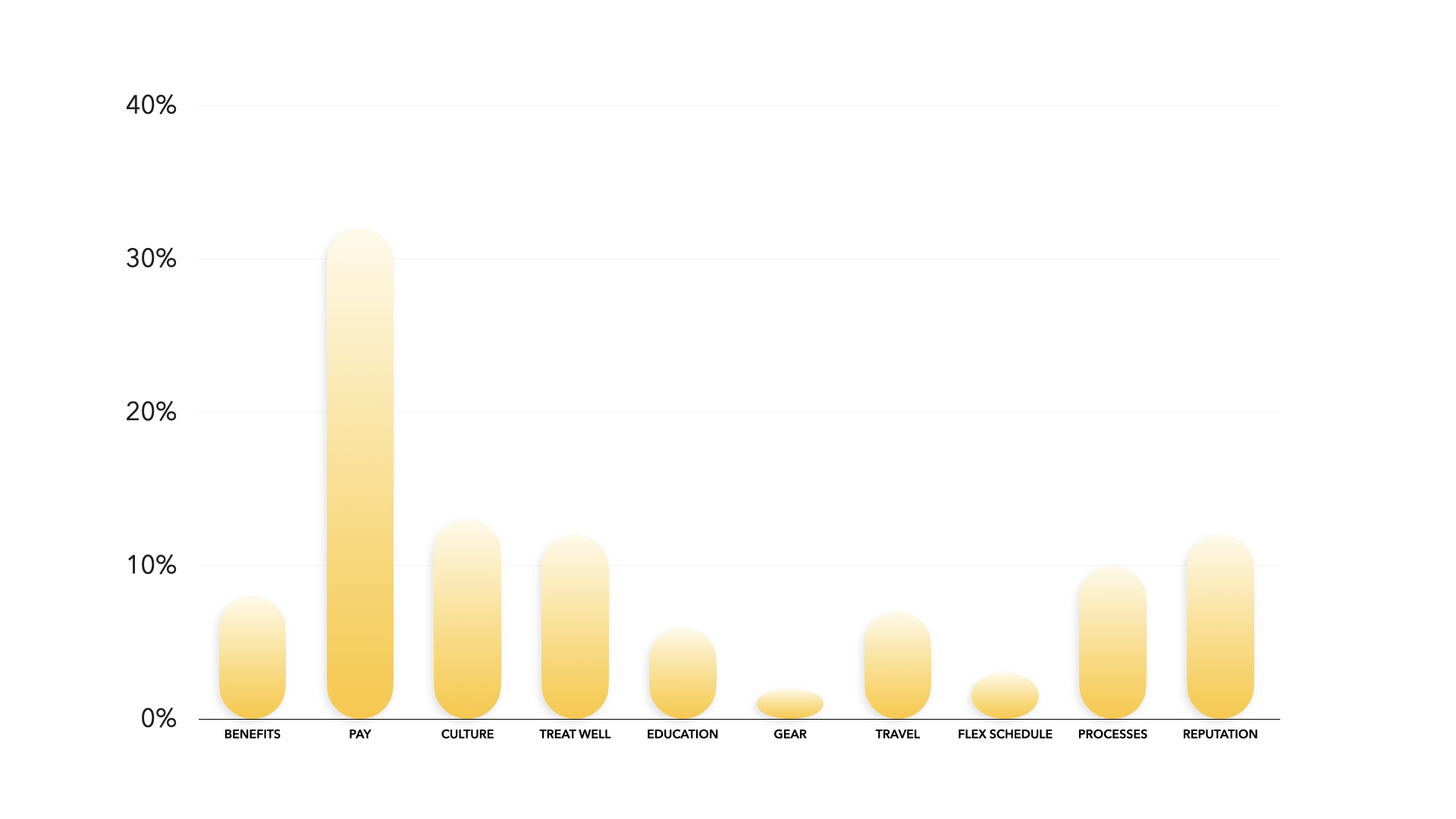

⭐️ Most popular answer

- Pay

🔥 Trending answers

- Culture

- Treat them well

- Reputation

- Processes

- Benefits

- Education

⭐️ Most popular answer

- State of the talent market

🔥 Trending answers

- Costs

- Lead time

- Gear shortage

- Learning

⭐️ Most popular answer

- More talent

🔥 Trending answers

- Single solution

- Respect

- Education

- Standardization

- Increased pay

- Ethics

- Diversity

- Gear rental

- Centralized talent pool

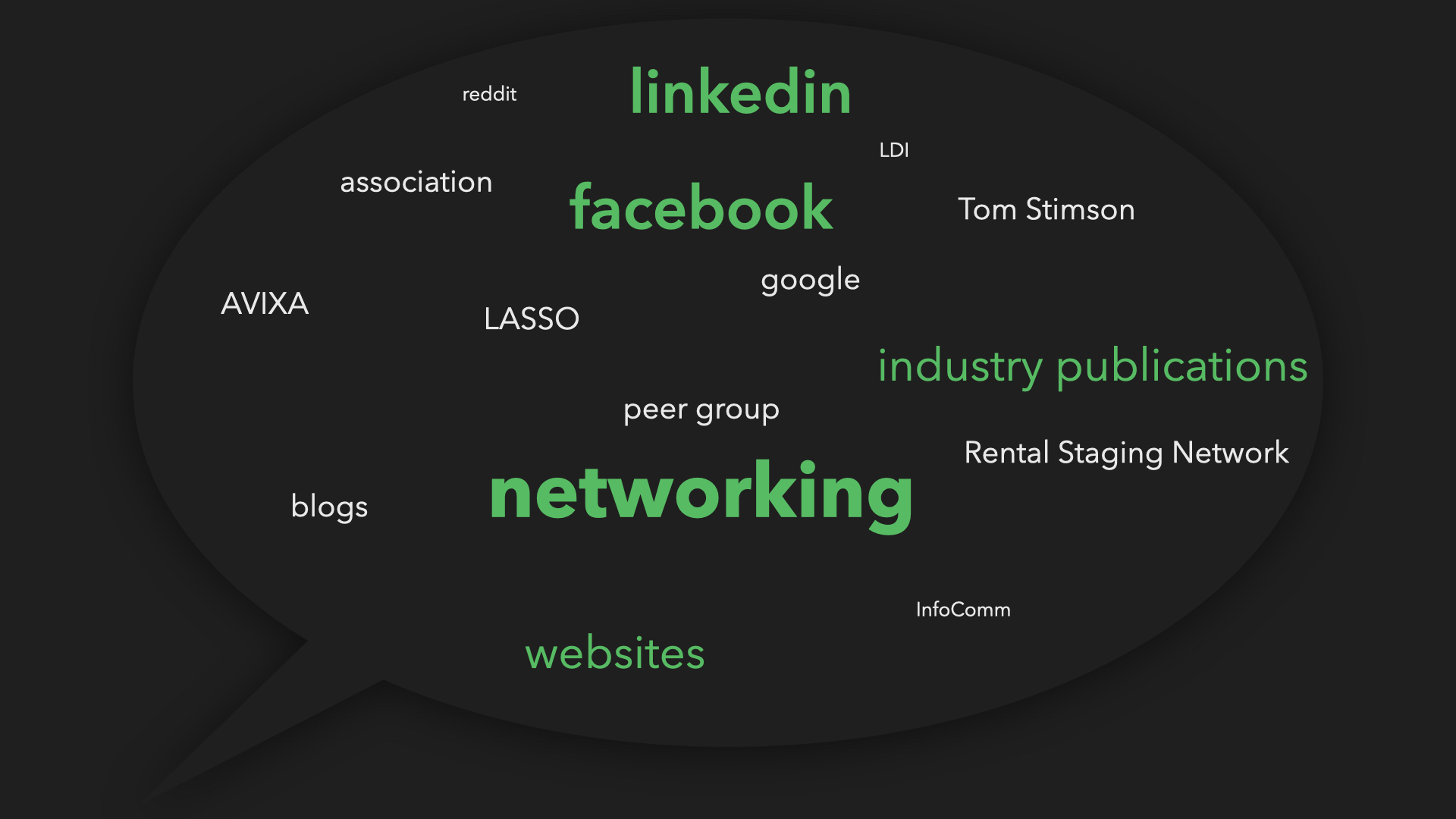

⭐️ Most popular answer

- Networking

🔥 Trending answers

- Websites

- AVIXA

- LASSO

- Tom Stimson

- Rental Staging Network (RSN)

- Industry publications

- Peer group

🔥 Trending questions

- What is my competitor's revenue over the last three years?

- What is my competitor's pricing?

- How many companies closed due to the pandemic?

- How many people left the industry due to the pandemic?

- Why is everything so last-minute?

- Why is everyone's pricing model so different and nothing is standardized?

⭐️ Most popular answers

- Finding talent

- Cash flow

🔥 Trending answers

- Inflation

- Work life balance

- Lead times

- Gear availability

- Being compliant

- Making payroll

- Worker misclassification

📬 Q3 Survey: Billing

- Billing rates

- Billing practices (and best practices)

- Discounts

- And more

📩 Email us at marketing@lasso.io to submit questions or to be placed on our participation list for the next survey.

🗣 Share this with a friend

Know someone in event production who would benefit from this?

Send them a link to the results ➜ https://platform.lasso.io/2022-soti-results